Mayor Sutcliffe's fight for financial fairness

How the federal government avoids paying property taxes, and Toronto's mind-blowing transit funding advantage

In a 30-minute speech in front of local reporters yesterday at City Hall, Mayor Mark Sutcliffe laid out a compelling case for financial fairness for the City of Ottawa from the provincial and federal governments.

He explained, in detail, two areas of structural inequities that are putting Ottawa on the brink of a financial and transit crisis. (If you haven’t watched his speech yet, you should go watch it on YouTube.)

This speech was a change of tone for Sutcliffe. This is the most direct and critical I’ve ever heard him be on inter-governmental relations.

“When I’ve advocated to other levels of government on behalf of our city, I’ve done it fairly and respectfully. I don’t thrive on drama or conflict, or negotiating publicly,” he said at the outset.

He’s made five requests to the provincial and federal government that add up to hundreds of millions of dollars, but it’s not a handout he’s looking for. It’s about fixing a broken federal property tax regime and restoring equity between how the province funds transit in the Greater Toronto area versus Ottawa.

1. How the federal government avoids paying property taxes

Instead of paying property tax on the real estate they own in Ottawa (including 90 office buildings), the federal government pays PILTs (Payment in Lieu of Taxes). They’re supposed to be the equivalent value of property taxes. Except that they’re not.

Instead of using independent property assessment values, the Federal government decides unilaterally how much they owe to the City. And despite residential and commercial properties paying more in property taxes year after year, the feds have somehow been paying less and less: $164-million in 2024, compared to $194-million in 2016. That revenue shortfall gets passed on to other property taxpayers in Ottawa.

Some examples: The feds decided a few years ago to stop paying taxes on any property with environmental protection zoning, costing the City $20-million so far. The NCC charges commercial tenants market rent, but decides arbitrarily how much to pay the City in PILTs – without passing any tax savings down to their tenants.1

Over at the Jackson Building downtown, the feds decided in 2017 to vacate the building and reduce the property taxes they pay on it, costing the City $261,000 in lost revenue each year – or $2.1-million since 2017.

The City is actually suing the federal government over their refusal to pay the education portion of property taxes, costing the City $45-million over the past three years.

“People often ask me what has surprised me since I became mayor,” said Sutcliffe. “The situation with our PILTs is more than a surprise, it’s a shock.”

“Imagine if I told you, as a property taxpayer, that you could decide how much you wanted to pay every year. Rather than have an independent valuation of your property, you could just choose your own valuation. Rather than have the tax rate set by the city, you could pick it yourself. Wouldn’t that be a great deal? Well, that’s exactly what the federal government gets to do.”

2. Toronto’s mind-blowing transit funding advantage

When Ottawa decided to build Phase 1 LRT in 2012, and Phase 2 LRT in 2019, it was based on an agreement that would see each level of government (Ottawa, Ontario, and Canada) pay a third of the cost.

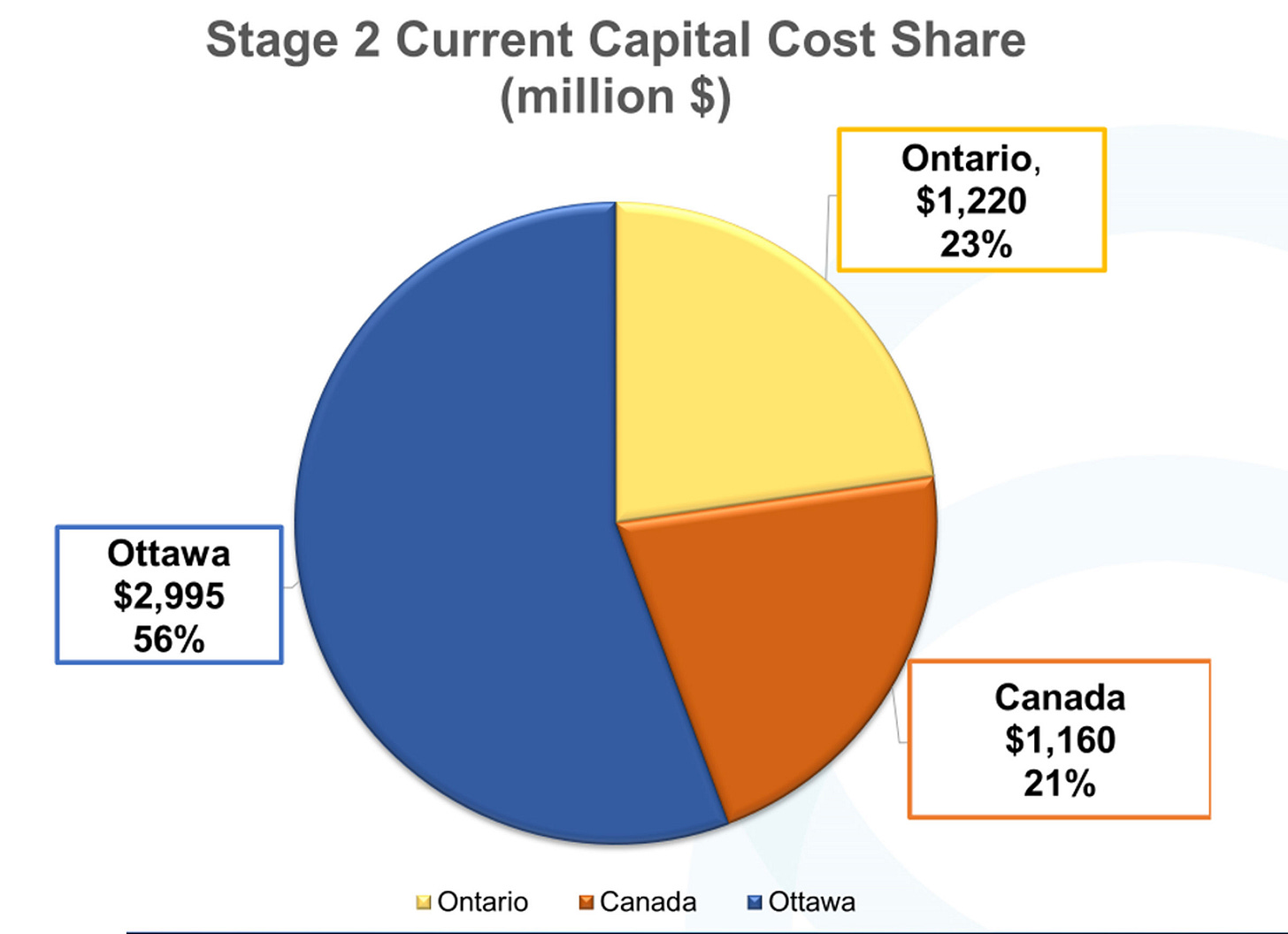

The reality? Well, on Stage 2, the province is paying 23% of the cost, the federal government 21%, and City of Ottawa taxpayers 56%!

But wait, it gets worse. In the Greater Toronto Area, many cities don’t pay any of the capital cost of transit. They’re either paid entirely by the province or split between the provincial and federal governments.

Here’s Mayor Sutcliffe’s summary:

“The Eglinton Crosstown light rail project in Toronto is costing about $14.5 billion. How much are Toronto residents contributing to that through their municipal taxes? Zero.

The Hurontario light rail project in Mississauga and Brampton will cost $4.6 billion. How much are Mississauga and Brampton residents contributing through their municipal taxes? Zero.

The Hamilton light rail project will cost $3.4 billion. How much are Hamilton residents contributing to that through their municipal taxes? Zero.”

To recap: Ottawa is paying 56% of the capital cost for Stage 2 LRT. Toronto, Mississauga, Brampton, and Hamilton are paying 0% of the capital costs for their light rail projects. And it’s a similar situation for operating costs as well.

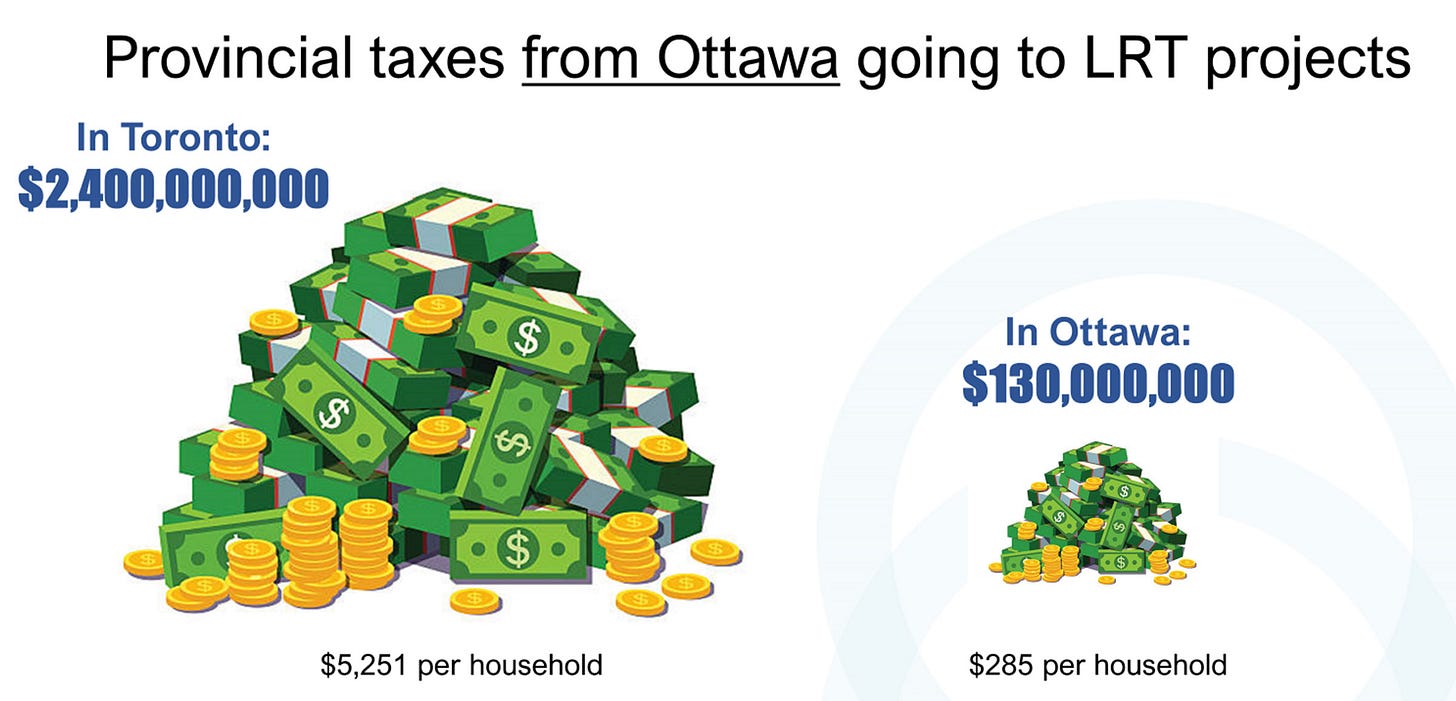

But wait, it gets worse: “It’s not just that Toronto residents aren’t paying for those projects through their municipal taxes,” said Sutcliffe. “It’s that Ottawa residents are paying for Toronto projects through their provincial taxes.”

Through provincial taxes, the average household in Ottawa has contributed $5,250 to transit projects in the GTA in the past few years. They contributed around $285 to Ottawa transit projects. For every dollar of your provincial taxes that pays for a transit project in Ottawa, over $18 goes to a project in the GTA.

3. What’s next?

Ottawa is facing a $140-million dollar shortfall in our transit budget for 2025 and beyond, just to maintain the current level of service. “That puts us in an absolutely impossible situation. There are no easy answers to a problem like that,” said Sutcliffe. “Without getting our fair share, without getting help from the other levels of government, it’s going to be very painful.”

Without federal help, we’re looking at a combination of:

Raising property taxes. To come up with $140-million, you would need to raise the transit levy by 37%, or a property tax increase of 7% just for transit. That’s hundreds of dollars more for every household.

Raisingtransit fares. Yesterday on CBC the Mayor said you’d need to raise fares by 72% to make up $140-million.

Cutting services, either to transit itself, or other city services so we can pay for transit.

4. Taking action

Mayor Sutcliffe is inviting residents to sign a petition at marksutcliffe.ca to support his “fight for fairness” for Ottawa.

And every resident in Ottawa needs to put pressure on federal MPs and provincial MPPs to do the right thing for local residents. There could be provincial and federal elections in 2025 and this would make a great local election issue, but we don’t have the luxury of time. We need to find a solution this fall, before we enter into our 2025 budget year. Unlike the federal and provincial governments, cities can’t run deficits.

Sutcliffe:

“This is an issue of fairness, pure and simple. It’s an issue of other levels of government who have more power and more resources and who simply must do the right thing to help us through this crisis… These are not unreasonable requests. It’s a very simple path forward that will allow the federal and provincial governments to help us when we need it most.”

5. Mayor Sutcliffe’s five “asks” to the federal and provincial governments

Reimburse unpaid payments in lieu of taxes (PILTs): The federal government must pay what it owes for the past five years, approximately $100 million.

Ensure fair PILTs: The federal government should stop unilaterally reducing payments and pay its fair share of property taxes.

Guarantee PILT levels during transition: Maintain PILT payments at the appropriate amount while exiting up to 50% of its Ottawa properties.

Restore fair transit funding: Reinstate the one-third funding model for transit projects so local taxpayers aren’t burdened with 56% of capital costs.

Support sustainable transit: Provide operational funds of $140-million for the next three years to ensure Ottawa’s transit system can recover from recent challenges and sustain operations for the future.

From Sutcliffe’s speech: “And by the way, this is the same NCC that charges the City of Ottawa full price for every little transaction we have with them. If we need an easement, they charge us what’s called ‘highest and best use’ for that sliver of land. For the LRT that passes through LeBreton flats the NCC charged us for every square metre of land as though there would be a 20-story office tower on it. We didn’t get to pay whatever we wanted. We had to pay full price: $52.6 million dollars. Meanwhile, the NCC refuses to pay their full share of taxes on LeBreton Flats.”

Completely agree with your points, it's unfair how much more the GTA gets transit funding.

I'm just not sure I see the province or feds stepping up when they may argue that Ottawa hasn't done enough to increase revenue yet. Toronto raised property taxes by 9.5%. Calgary raised by 8%. Vancouver by 7.5%. Ottawa only raised by 2.5%.

I agree with many points in this but remain unconvinced. Consider: historical austerity budgets and decades of too-low tax increases have deprived the city of (around) $1.4b in taxes (had we kept pace with other cities) which would have been in the range of $350m additional this year alone. Additionally, council continues to spend money we don't have on projects that don't make sense: $600m for a new suburb (Tewin) that will lock in forever sprawl; $500m (and counting) for Lansdowne as a direct subsidy to prioritize private profit for sports; over $100m per year, with an 8 year commitment to the tune of nearly a billion dollars on suburban and rural road expansions and widenings. We committed to Phase 2 of LRT because Phase 1 was (in the words of then Mayor Watson "a stunted 12km system that is going to clog in the Tunney’s pasture area and Blair station" so we had no choice (due to poor design) to proceed and we went ahead knowing the funding formula (maybe council should have negotiated harder to get a better deal then or refused to proceed with the project).

My point is: yes, we need a new funding model for cities and yes, we need a better and fairer deal for the nation's capital, but what have we done to deserve it?

And missing from this conversation about fairness is the one-sidedness of it: sure, Ottawa has a disproportionate percentage of downtown office buildings and dependence on federal workforce. We also have billions of dollars in construction investment that other cities don't have (parliament hill, supreme court, other major federal projects); we have the NCC building and maintaining our parks and best tourist attractions while the city does little or nothing in that realm. We have national museums and festivals that attract millions of tourists and represent billions in investments and tourist revenue that no other Canadian city has. Perhaps that should be considered before complaining, in isolation, that PILTs are not equitable.