Ottawa's new development charges explained (with charts!)

Finding a balance between DC's and affordability

Over the past week we’ve been reading warnings about the link between municipal development charge and housing affordability. A closer look at the numbers makes me doubt that Ottawa’s modest increase will throw the market into chaos or cause the City to miss its federal housing targets.

Development charges (DC’s) are the main financial tool that cities have to pay for the capital cost of municipal infrastructure: roads, transit, water, sewer, recreation centre, fire stations, libraries and so on.1 DC’s are assessed to developers, who pass on these costs to new owners and renters.2 Hundreds of millions of dollars are collected each year.

It’s one of the most straightforward budgeting exercises that we do at City Hall. Every five years, City staff hire a consultant to input the estimated cost of municipal infrastructure from the Infrastructure Master Plan, Transportation Master Plan, Parks and Recreation Master Plan, and so on. They match that against population and growth projections from the Official Plan and the Census, apply some formulas as directed in Devlopment Charges Act (1997), and output a flat fee for every new home, apartment, commercial development and industrial facility built in the City.

Last week, after plugging in all the numbers, Ottawa’s Planning and Housing Committee approved a DC increase of about 11-12%. Much of that increase reflects rising construction costs due to supply chain challenges, labour shortages, and inflation.

Here’s what the proposed new fees look like. (Ottawa has a different DC rate inside and outside the Greenbelt.)

Here’s how the DC is calculated, broken down by service area.

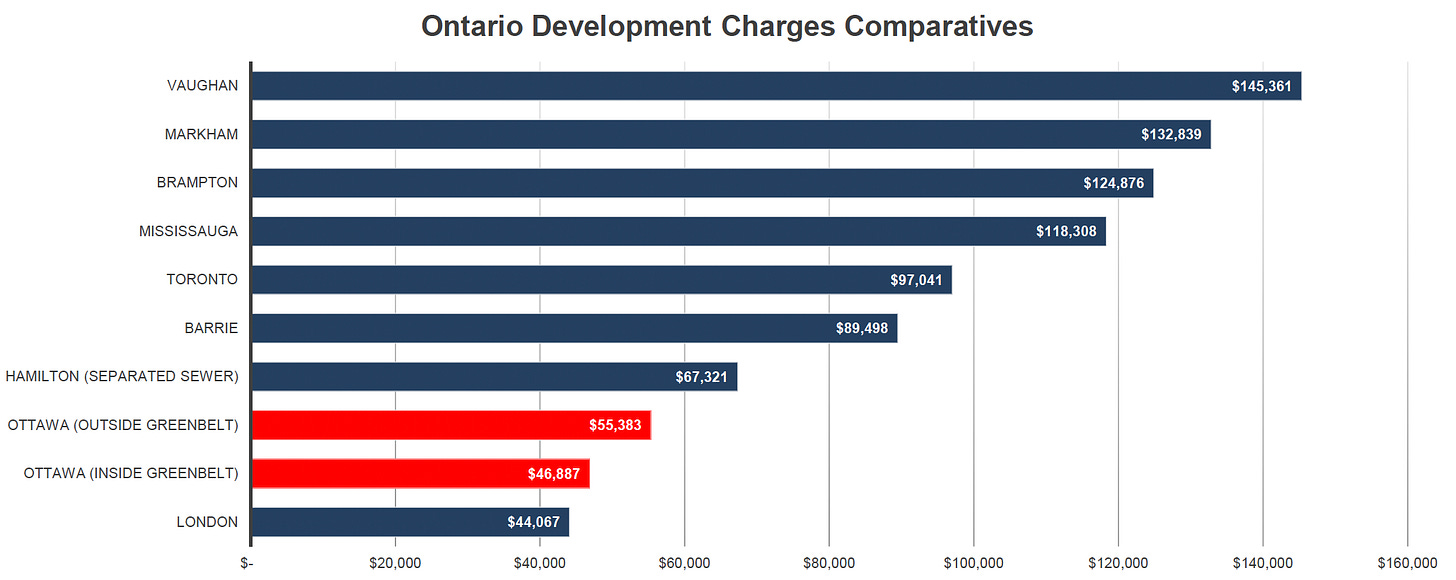

Our rates are still substantially less than other municipalities in Ontario.

These increases aren’t trivial, and they do have an effect on prices. But Ottawa’s DC increases are modest when you compare them to the total price of a new townhome or single. I looked at prices in the new Abbott’s Run community in Stittsville for example:

Least expensive townhome: $659,900. Additional DC increase of $4,896 equals 0.7% of the total cost.

Least expensive single: $839,900. Additional DC increase of $6,220 equals 0.7% of the total cost.

The most expensive “executive home” that I could find was $1,134,900. Additional DC increase of $6,220 equals 0.5% of the cost.

So no, I don’t think these additional fees are going to cause a drastic slowdown in Ottawa’s housing market, nor is it high enough to cause more buyers to buy in far-flung suburbs like Arnprior or North Grenville instead.

***

The problem with DC’s

DC’s add to the cost of new housing, so they do affect affordability. New homeowners carry the fees on their mortgages for years, and they’re factored into the rents of new apartments over the long term. This impacts new owners and renters, who are often younger, or new Canadians.3

Infrastructure costs money, and I’ve never heard residents ask for fewer rec centres or roads, or for amenities to get built more slowly. Infrastructure has to be funded somehow, but if not DC’s, then with what?

One option would be to shift more of the cost of new infrastructure to property taxes. But that would mean hundreds (maybe thousands?) of dollars added to everyone’s property tax bill, creating its own equity and affordability impacts.

You could borrow some of the money, but that’s expensive too. Ottawa spends about $180-million per year on capital infrastructure and if we took out a loan for that, the ensuing interest would also boost the property tax bill. (Not to mention there are strict limits on how much debt a municipality can carry.)

That leaves funding from other levels of government. The provincial and federal governments are starting to send signals that the beginning of the end of DC’s might be near. For example, the latest federal budget dangled a $6 billion fund for cities across Canada on condition that they freeze DC’s for three years. Details on this and other programs are scant, but maybe in future years this funding could offset DC’s, or even allow us to start phasing them out altogether.

Here in Ottawa, DC’s will almost certainly rise again in the next couple years as we complete a new Infrastructure Master Plan and Transportation Master Plan, adding costs to the DC spreadsheet. It’s going to be an increasing challenge to find the right balance between paying for infrastructure and arriving at a DC rate that’s fair for everyone.

Post script (May 14)

AMO put out a backgrounder on DC’s a couple of years ago that offered a few insights into affordability:

“When we look at affordability, development charges (DCs) account for between 5-7% of the price of a new home. The cost of lumber and supplies, interest rates, economics, land costs, and developer profits are significant factors when it comes to the cost of a new home. In looking at the impact of development charges, a study by the Royal Bank and the Pembina Institute concluded that, “the increase in these charges accounts for only a small fraction of the increase in home prices”.

Experience has shown development charge reductions are not passed on to the home buyer. For example, the City of Ottawa experimented with offering DC concessions in a specific area. The concessions offered did not lower the price of housing compared to other areas in the city. In the GTA, on the border of two municipalities with different development charges, the municipality with lower DCs in fact had higher housing prices.”

In Stittsville, the cost of the Carp Road upgrade from Hazeldean Road to the Queensway is estimated at $35,616,000, with 95% of that coming from development charges and the rest paid for by property taxes. Other projects substantially funded by development charges include Robert Grant Avenue (from Hazeldean to Palladium), a Transitway on Robert Grant south of Hazeldean; the Fernbank District Park and Kanata West District Park; various sewers and pump stations; a multi-use pathway along Terry Fox; and upgrading the intersection at Terry Fox and Cope.

Affordable housing built by non-profit developers is exempt from development charges.

Recommended listening: Doing away with development charges - Andrew Sancton (via Municipal World)